Bitcoin Transaction Fees Outpace Ethereum for the First Time in Five Years

Recent data reveals that Bitcoin transaction fees have surpassed those of Ethereum, marking a significant shift in the fee landscape. Analyst James V. Straten explains that transaction fees refer to the amount users must pay to validators (miners for BTC and stakers for ETH) for processing their transactions on the network.

When the blockchain experiences congestion due to high user activity, fees can skyrocket. The limited capacity of the blockchain leads to longer waiting times in the mempool, prompting users to attach higher fees for faster transaction processing. Conversely, during periods of low network activity, users have no incentive to pay higher fees.

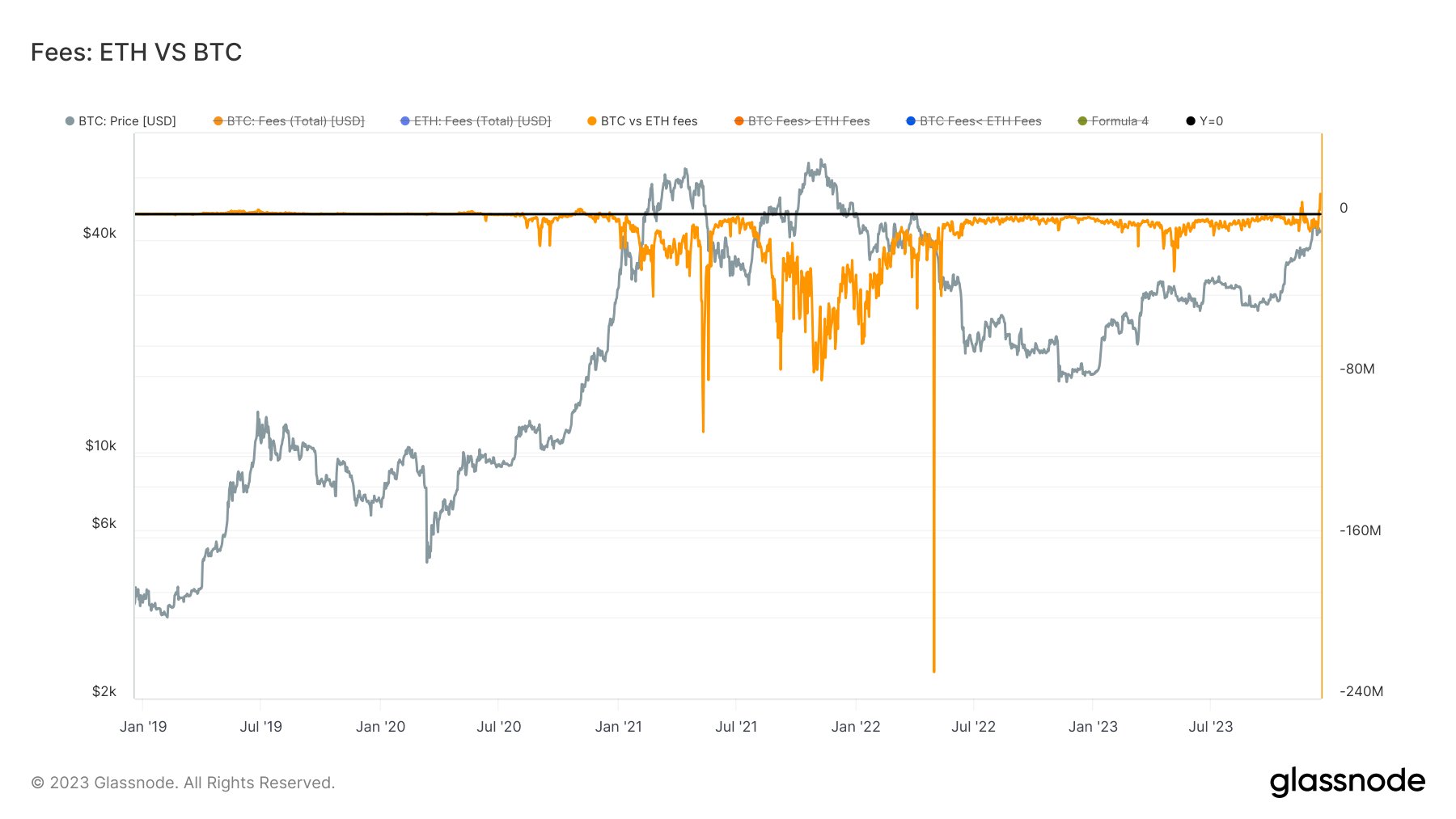

A chart depicting the total daily fees on both networks over the past five years highlights this recent divergence:

Rare Occurrence: Bitcoin Fees Surpass Ethereum’s

The graph clearly shows that Bitcoin transaction fees have exceeded those of Ethereum in recent days, a rarity considering ETH has historically had higher fees over the past five years. The current discrepancy between the two metrics is particularly noteworthy.

The surge in BTC fees can be attributed to increased activity driven by the recent market rally. However, Ethereum has also benefited from this rally, experiencing its own surge. The key factor driving the fee difference between the two networks is the resurgence of Inscriptions.

The Role of Inscriptions in Fee Disparity

Inscriptions are special BTC transactions that directly inscribe data onto the blockchain. Their popularity has grown significantly, impacting blockchain economics and contributing to fee spikes. The chart reveals that BTC fees surpassed ETH fees in the past, with Inscriptions like BRC-20 tokens and NFTs playing a significant role. This time, the spike is even more pronounced, indicating the continued growth of this transaction type.

Bitcoin Price Update

Over the last 24 hours, Bitcoin has experienced a price drop and is currently hovering below $41,000.

Hot Take: Bitcoin Fees Surpass Ethereum Due to Inscriptions’ Influence

The recent surge in Bitcoin transaction fees, surpassing those of Ethereum for the first time in five years, can be attributed to the growing popularity of Inscriptions. These special transactions that directly inscribe data onto the blockchain have caused a significant increase in fees. While high activity driven by market rallies plays a role in fee spikes, it is the Inscriptions that have been the primary instigator of this fee disparity. This trend highlights the evolving dynamics of blockchain economics and emphasizes the impact of different transaction types on network fees.

By

By

By

By

By

By

By

By

By

By