Yearn Finance’s YFI Token Plummets

Within the last 24 hours, Yearn Finance’s YFI token experienced a sharp decline of over 40%. This led to significant liquidations amounting to approximately $5 million. Many began to speculate about the protocol following this sudden price drop.

YFI’s Market Cap Decline

The sudden sell-off caused Yearn Finance’s market cap to drop by around $200 million, from $482 million to $296 million. Data from Coinglass suggests that traders holding YFI positions were liquidated for approximately $5 million, with $3.5 million from long positions and $1.42 million from short positions.

Derivatives trading volume for the DeFi token increased by 26% to about $2 billion, with open interest rising to approximately $162.54 million. Major exchanges noted significant declines in YFI token open interest positions alongside the liquidations.

Factors Behind the Crash

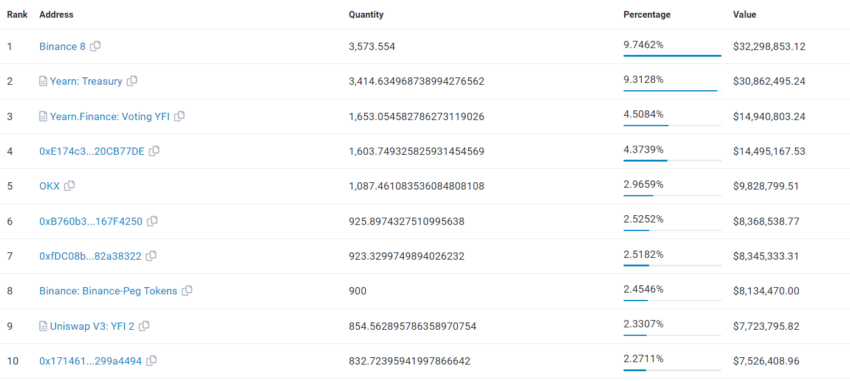

Observations suggest that nearly half of YFI’s supply is held in 10 wallets, leading some to speculate that project insiders caused the selling pressure. Crypto trader Skew described the YFI’s price movement as a “pretty deliberate rug.”

On-chain analysis also reported a significant whale transfer, with a wallet moving 446 YFI worth roughly $5.8 million, most of which was deposited into exchanges. This situation follows domain registrar issues faced by the protocol in September, resulting in usability problems.

Hot Take: Yearn Finance Faces Significant Price Drop

Yearn Finance’s YFI token faced a substantial decline of over 40% within 24 hours, leading to significant liquidations and market cap reductions. Speculation arose about the cause of the crash, with some attributing it to project insiders and significant whale transfers. The protocol’s usability issues in September further raised concerns about its stability and security.

By

By

By

By

By

By

By

By

By

By