Bitcoin Whales Selling, But Sharks Increasing Holdings

According to data from on-chain analytics firm Santiment, large Bitcoin (BTC) wallets are displaying an interesting pattern. The “Supply Distribution” indicator tracks the total amount of Bitcoin held by different wallet groups.

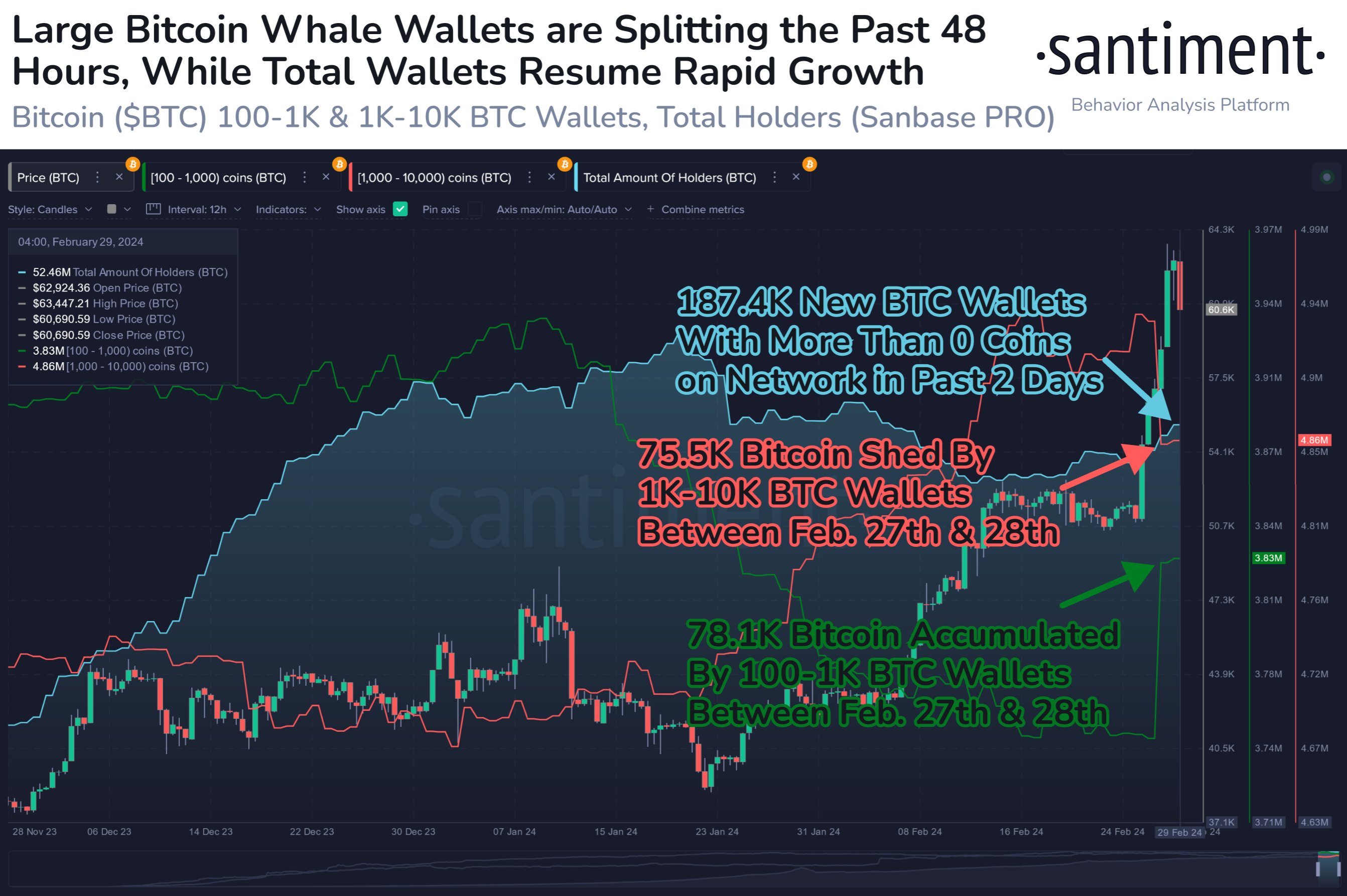

Wallet addresses are divided into cohorts based on the number of tokens they hold. The two cohorts of interest in this context are sharks and whales. Sharks are investors who own between 100 and 1,000 BTC, while whales are those with 1,000 to 10,000 BTC.

The behavior of these large balance holders can have an impact on the wider market. Whales, with their significantly greater holdings, are the more influential group.

Whales Shedding BTC While Sharks Accumulate

The chart below shows the trend in Bitcoin Supply Distribution for whales and sharks over the past few months:

As seen in the graph, whales have sold around 75,500 BTC from their holdings during the recent rally in Bitcoin’s price. On the other hand, sharks have been accumulating BTC and have acquired 78,100 coins.

There are two possible explanations for this trend:

- The sharks may have bought these tokens from the whales.

- The whales may not actually be selling but rather redistributing their holdings into smaller wallets.

The latter scenario could explain the observed effect on the market. It is likely that the whales are breaking down their wallets into smaller portions for various reasons, such as moving tokens into or out of exchanges or taking security precautions.

While some selling pressure may have occurred, the market has been able to absorb it relatively well so far, as the Bitcoin price has remained stable.

Bitcoin Price

Bitcoin recently dipped to the low $60,000 levels but has quickly bounced back and is currently trading at around $62,400.

Hot Take: Whales and Sharks in the Bitcoin Market

On-chain data suggests that Bitcoin whales have been participating in a large distribution of coins, while sharks have been accumulating more. This behavior from these large balance holders can impact the wider market. However, despite the selling pressure from whales, the Bitcoin price has managed to hold on relatively well.

It is interesting to see that while whales have sold a significant amount of BTC, sharks have bought almost the same amount. This could be due to sharks buying tokens from whales or whales redistributing their holdings into smaller wallets.

The Bitcoin price recently experienced a dip but quickly recovered. It is currently trading at around $62,400.

Bitro Conwell stands as an intellectual architect, weaving together the roles of crypto analyst, meticulous researcher, and editorial virtuoso with finesse. Amidst the digital intricacies of cryptocurrencies, Bitro’s insights resonate harmoniously with seekers of all stripes, showcasing a profound understanding. His ability to untangle the most complex threads within the crypto landscape seamlessly pairs his their editorial finesse, transforming intricacy into an artful tapestry of comprehension.