In a recent address, Deputy Treasury Secretary Wally Adeyemo called on Congress to bolster the Biden administration’s efforts to combat illicit use of crypto.

Adeyemo’s appeal comes amid fears of militant groups like Hamas using digital assets for funding activities.

US Regulators Continue to Blame Crypto

Adeyemo made his stance clear at the annual meeting of the Securities Industry and Financial Markets Association in Washington. He expressed the need for Congress to grant enhanced powers to help regulate the crypto sector. To stress this, he highlighted the alleged use of digital assets by Hamas.

The October 7 attack on Israel by Hamas has intensified the scrutiny of digital assets’ illicit use. Signaling a push for legislative action, Adeymo stated: “There are places where we think Congress needs to act.”

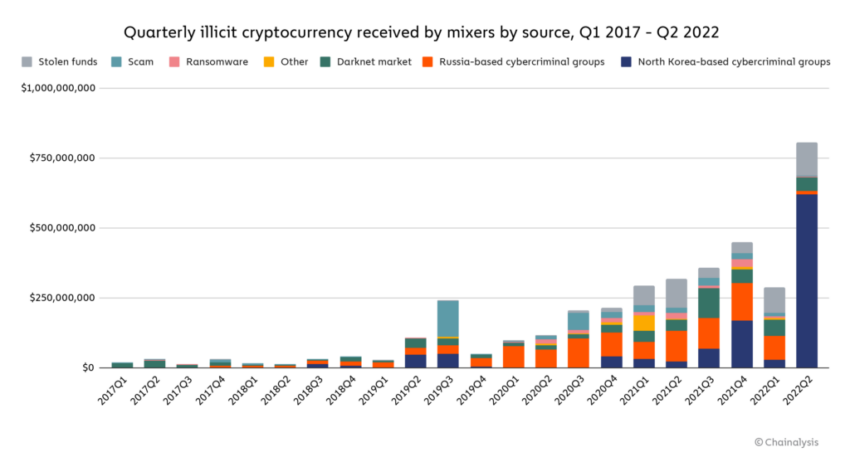

He further emphasized that the Treasury Department would continue to take action and collaborate with lawmakers while urging the cryptocurrency industry to innovate responsibly. The Treasury Department has previously identified international ‘mixers’ as potential money-laundering hubs. Mixers are cryptocurrency exchanges that can obfuscate the source of funds. Militant groups like Hamas and Palestinian Islamic Jihad have links to these platforms. Adeyemo urged the industry to self-regulate and prevent using crypto for illicit activities or “heinous acts.”

Read more: Coinomize Review 2023: Is This the Right Coin Mixer for You?

Overstating the Illicit Role of Crypto in Terror Financing

Contrary to the narrative of significant crypto donations to Hamas, blockchain analytic firm Elliptic clarified that only $21,000 has been donated to the group through cryptocurrency.

Amid the Israel-Hamas conflict, there were reports of the militant organization receiving millions in crypto donations. However, Elliptic debunked these claims, stating: “Only $21,000 in cryptocurrency has been donated since October 7.”

Significantly, crypto service providers froze a large portion of this amount. Tether, the issuer of USDT, froze $9,000 in stablecoin donations. This level of transparency and traceability is a unique feature of cryptocurrency, unlike traditional finance.

In response to these revelations, some in the cryptocurrency sector have argued that the role of digital assets in funding terrorist organizations has been overstated. This ongoing debate also underscores the importance of Adeyemo’s call for increased self-regulation within the industry and the need for Congress to act, ensuring the responsible and secure use of digital assets.

Hot Take: Reevaluating Crypto’s Role in Terror Financing

The conversation about terrorist organizations using crypto for funding is complex. While there is evidence that some groups have utilized digital assets for illicit activities, it’s essential not to overstate their impact. Adeyemo’s call for increased self-regulation and congressional action reflects a growing need for responsible use of crypto while addressing legitimate concerns about its misuse.

Bernard Nicolai emerges as a beacon of wisdom, seamlessly harmonizing the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the labyrinth of digital assets, Bernard’s insights echo like a resonant chord, touching the minds of seekers with diverse curiosities. His talent for deciphering the most intricate strands of crypto intricacies seamlessly aligns with his editorial finesse, transforming complexity into a captivating narrative of comprehension. Guiding both seasoned adventurers and inquisitive newcomers, Bernard’s insights forge a compass for informed decision-making within the ever-evolving tapestry of cryptocurrencies. With the artistry of a wordsmith, they craft a narrative that enriches the evolving chronicle of the crypto cosmos.