FTX Holds Over $3 Billion in Crypto Assets, According to Court Documents

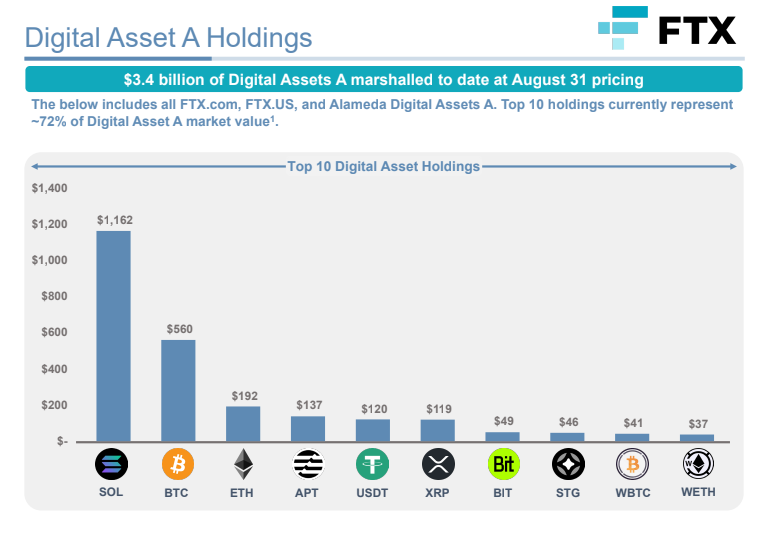

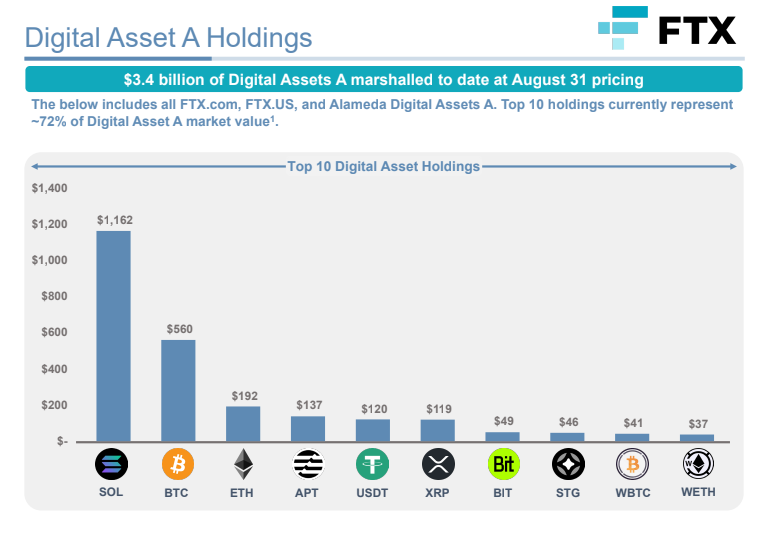

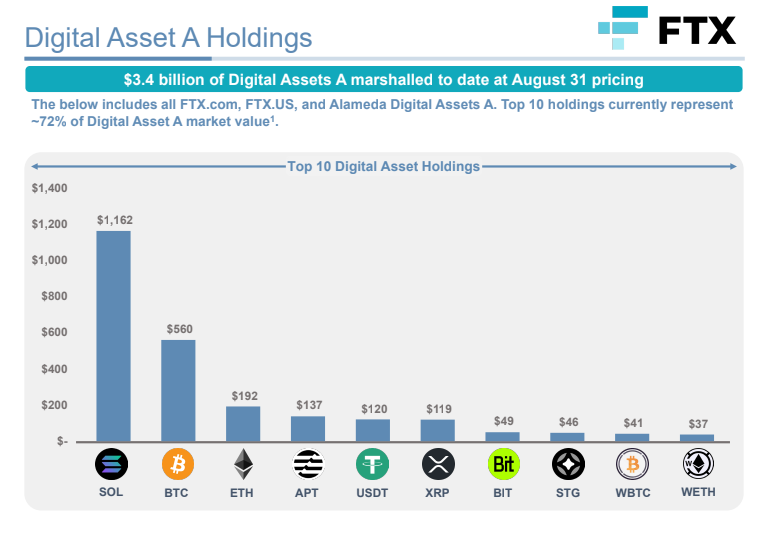

Court documents have revealed that FTX, the bankrupt crypto exchange, still holds more than $3 billion in assets as of August 31. The information was shared on Twitter by crypto reporter Colin Wu. The assets held by FTX include $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), and $192 million in Ethereum (ETH). Other assets held by the exchange include APT (Aptos), USDT (Tether), XRP, BIT (BitDAO), STG (Stargate Finance), WBTC (Wrapped Bitcoin), and WETH (Wrapped Ethereum). The documents also show that FTX has secured funds through the Chapter 11 process, with $2.6 billion of debtor and non-debtor cash confirmed to date. FTX also holds more than $500 million worth of securities in its brokerage accounts, including investments in Grayscale and BitWise funds.

FTX’s Crypto Assets and Cash Holdings

The bankrupt crypto exchange FTX is still holding more than $3 billion in assets, according to court documents. As of August 31, FTX held $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), and $192 million in Ethereum (ETH). The exchange also holds assets such as APT (Aptos), USDT (Tether), XRP, BIT (BitDAO), STG (Stargate Finance), WBTC (Wrapped Bitcoin), and WETH (Wrapped Ethereum). In addition to the crypto assets, FTX has secured funds through the Chapter 11 process, with $2.6 billion of debtor and non-debtor cash confirmed. The court records also reveal that FTX holds over $500 million worth of securities in its brokerage accounts, including investments in Grayscale and BitWise funds.

FTX’s Financial Status and Securities Holdings

According to court documents, FTX has a significant amount of assets and cash holdings. As of August 31, the bankrupt crypto exchange held over $3 billion in crypto assets, including $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), and $192 million in Ethereum (ETH). FTX has also secured funds through the Chapter 11 process, with $2.6 billion of debtor and non-debtor cash confirmed. Additionally, FTX holds more than $500 million worth of securities in its brokerage accounts. The securities investments include $70 million in the Grayscale Ethereum trust, $36 million in the BitWise 10 Crypto Index Fund, and $417 million in Grayscale’s Bitcoin trust, which accounts for 79% of FTX’s securities holdings.

Hot Take: FTX’s Substantial Holdings Amid Bankruptcy

Court documents have revealed that FTX, the bankrupt crypto exchange, still holds over $3 billion in assets, including significant amounts of Solana, Bitcoin, and Ethereum. Despite its bankruptcy status, FTX has secured funds through the Chapter 11 process and holds more than $500 million worth of securities in its brokerage accounts. These holdings indicate that FTX still has substantial value despite its financial difficulties. It remains to be seen how these assets will be managed and whether they will be used to repay creditors. The situation highlights the complex and evolving nature of the crypto industry, where bankrupt entities can still possess significant digital asset holdings.

Daisy Hodley emerges as a luminary blending the roles of crypto analyst, devoted researcher, and editorial virtuoso into a harmonious symphony. In the realm of digital currencies, Daisy’s insights resonate with an exquisite resonance across a diverse spectrum of minds. Her adeptness in decoding intricate threads of crypto complexities seamlessly intertwines with her editorial finesse, translating intricacy into a captivating melody of understanding. A guiding star for both intrepid explorers and curious novices venturing into the crypto realm, Daisy’s insights form a compass for discerning decision-making amidst the ever-shifting currents of cryptocurrencies. With the touch of a literary artist, they craft a narrative that enriches the evolving mosaic of the crypto landscape.