In a bid to strengthen its cryptocurrency regulatory framework, Cyprus has issued a stern warning to Crypto Service Providers (CSPs): register or face severe penalties.

The island nation is cracking down on the crypto industry and adopting standards set by the global Financial Action Task Force (FATF) to combat money laundering and terrorism financing.

Cyprus Tightening Crypto Exchange Rules

Cyprus plans to impose strict penalties on CSPs that fail to register with the Cyprus Securities and Exchange Commission (CySEC), regardless of their registration status in other EU states. The Ministry of Finance has proposed an amendment to the “Prevention and Suppression of Money Laundering Law” to enforce this.

Non-compliant CSPs could face penalties such as fines of up to €350,000 and imprisonment of up to five years. This demonstrates the government’s commitment to minimizing risks associated with illegal activities and terrorism financing.

The Cyprus Bar Association has raised concerns about the obligation for CSPs registered in other EU member states to also register in Cyprus. However, the Finance Ministry argues that the initial responsibility for monitoring these entities lies with the state where they were first registered.

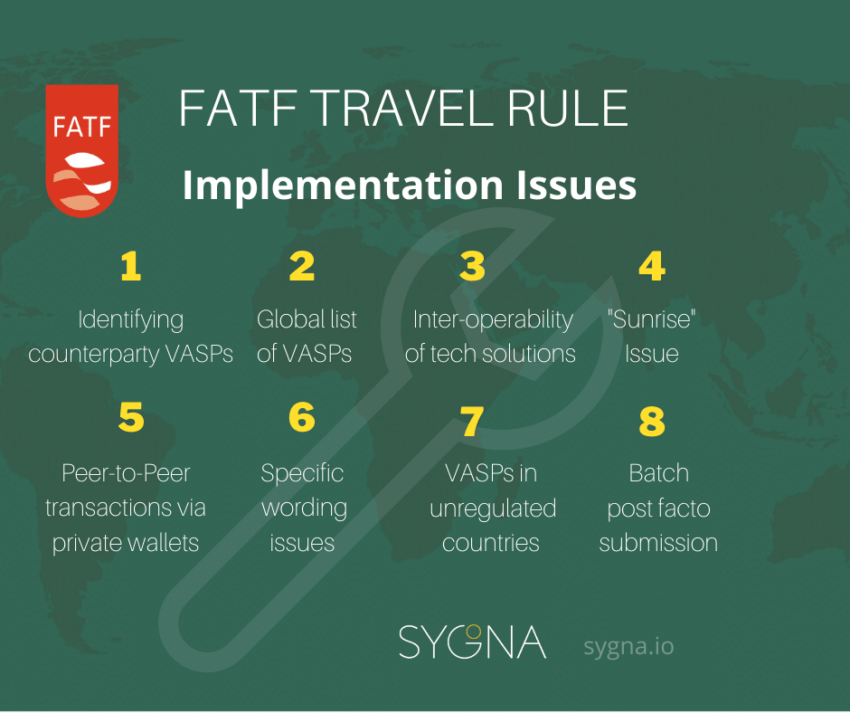

FATF Pushing for Widespread ‘Travel Rule’

In addition to tightening regulations, Cyprus is considering implementing the “Travel Rule.” This rule would require CSPs to share customer information during transactions, aiming to prevent money laundering and other illicit activities.

In light of the US crackdown on crypto firms, Europe is becoming a popular destination for these entities. eToro, a crypto and stocks trading platform, has recently registered as a CSP with CySEC. It has also received regulatory approval from the European Union (EU), allowing it to expand its services to all EU countries through a single entity starting July 2024.

Dr. Hedva Ber, the deputy CEO at eToro, stated that Europe is crucial for their business and they want to continue offering European investors access to a wide range of crypto assets as part of a diversified portfolio.

Hot Take: Cyprus Strengthens Cryptocurrency Regulation to Combat Money Laundering and Terrorism Financing

Cyprus is taking significant steps to establish a well-regulated cryptocurrency environment by enforcing strict registration requirements for Crypto Service Providers (CSPs) and considering the implementation of the “Travel Rule.” By aligning with global standards set by the FATF, Cyprus aims to combat money laundering and other illicit activities in the crypto industry. These measures demonstrate the government’s commitment to minimizing risks associated with illegal practices and terrorism financing. As Europe becomes an attractive destination for crypto firms amidst regulatory actions in other jurisdictions, Cyprus is positioning itself as a regulated hub for these entities. With eToro already registering as a CSP in Cyprus, the country is poised to attract more crypto businesses seeking compliance and regulatory approval.

Bernard Nicolai emerges as a beacon of wisdom, seamlessly harmonizing the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the labyrinth of digital assets, Bernard’s insights echo like a resonant chord, touching the minds of seekers with diverse curiosities. His talent for deciphering the most intricate strands of crypto intricacies seamlessly aligns with his editorial finesse, transforming complexity into a captivating narrative of comprehension.