Binance Overtakes CME in Bitcoin Futures Open Interest

After four months, Binance has surpassed the Chicago Mercantile Exchange (CME) in Bitcoin futures open interest. The demand for spot Bitcoin ETFs from institutional investors has placed CME at the top of derivatives trading for the past few months.

With a notional open interest of 105,130 BTC worth $4.52 billion, Binance is now the largest Bitcoin futures exchange once again. CME ranks second with a notional open interest of 101,410 BTC valued at $4.35 billion.

In the last 24 hours, BTC open interest on Binance increased by 2%, while it decreased by over 3% on CME. This indicates a continuous decline in demand for spot Bitcoin ETFs from institutional investors.

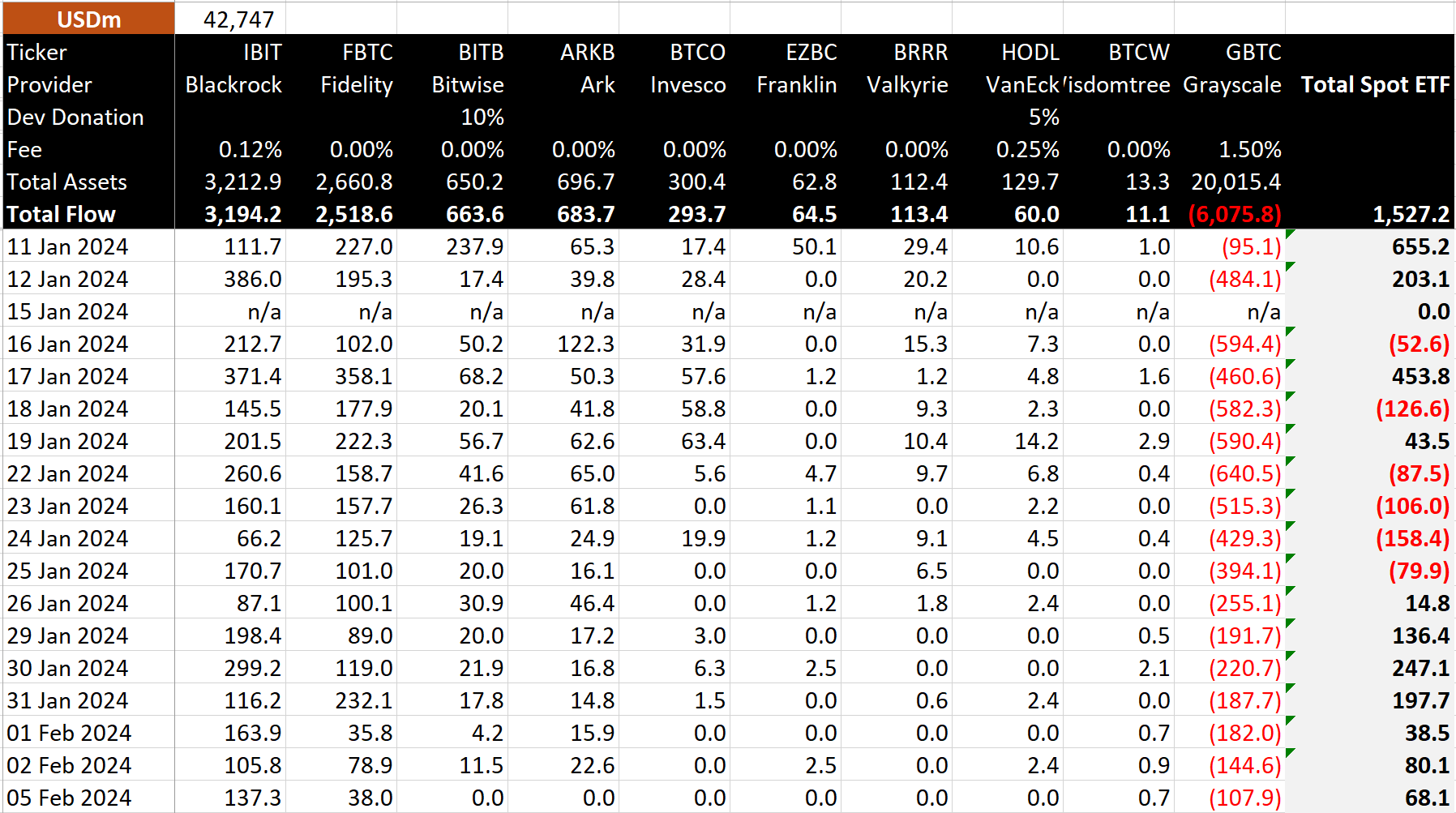

According to Bitcoin ETF flow data, spot Bitcoin ETFs saw a net inflow of $68 million until February 5. However, GBTC experienced an outflow of $108 million, indicating a significant drop in demand for spot Bitcoin ETFs.

On Monday, BlackRock’s spot Bitcoin ETF (IBIT) witnessed an inflow of over $137 million, showing an increase compared to Friday’s inflow.

The Importance of Bitcoin ETF Options

Nate Geraci, president of ETF Store, emphasized the crucial role of approving spot Bitcoin ETF options in the market. The timing of approval also plays a significant role, as the liquidity leader in the ETF category historically charges higher fees. In order to remain a leader and charge high fees, Grayscale will need a robust derivatives ecosystem built around the underlying ETF. Currently, GBTC charges a management fee of 1.5% for its spot Bitcoin ETF.

Geraci believes that the longer it takes to approve spot Bitcoin ETF options, the worse it will be for the current liquidity leader, GBTC. He advocates for the approval of options without delay.

The price of BTC has been trading at $42,9211 in the past 24 hours, with a low of $42,298 and a high of $43,494. Additionally, trading volume has increased by nearly 15% in the last 24 hours, indicating growing interest among traders.

Hot Take: Binance Surpasses CME in Bitcoin Futures Open Interest

Binance has regained its position as the largest Bitcoin futures exchange by surpassing CME in open interest. The decline in demand for spot Bitcoin ETFs from institutional investors has contributed to this shift. It is important for the market to approve spot Bitcoin ETF options, as it plays a crucial role in maintaining liquidity and charging higher fees. The longer the approval process takes, the more it may impact current liquidity leader GBTC. With BTC trading at a relatively stable price and increasing trading volume, it remains to be seen how these developments will shape the future of Bitcoin futures and ETFs.

Gapster Innes emerges as a visionary adeptly blending the roles of crypto analyst, dedicated researcher, and editorial maestro into an intricate tapestry of insight. Amidst the dynamic world of digital currencies, Gapster’s insights resonate like finely tuned harmonies, captivating curious minds from various corners. His talent for unraveling intricate threads of crypto intricacies melds seamlessly with his editorial finesse, transforming complexity into an eloquent symphony of comprehension.