Bitcoin Liquidation: Over $74 Million of Positions Closed

The crypto community was thrilled when Bitcoin prices surged to approximately $30,000 on October 16, fueled by rumors that the US Securities and Exchange Commission (SEC) had given the green light to the first spot Bitcoin Exchange-Traded Fund (ETF). However, these reports turned out to be false, causing prices to fluctuate dramatically and leading to losses for many traders. In total, more than $74 million worth of derivatives positions were liquidated across various exchanges, with OKX, Binance, and Bybit being the most affected.

Significant Short and Long Positions Liquidated

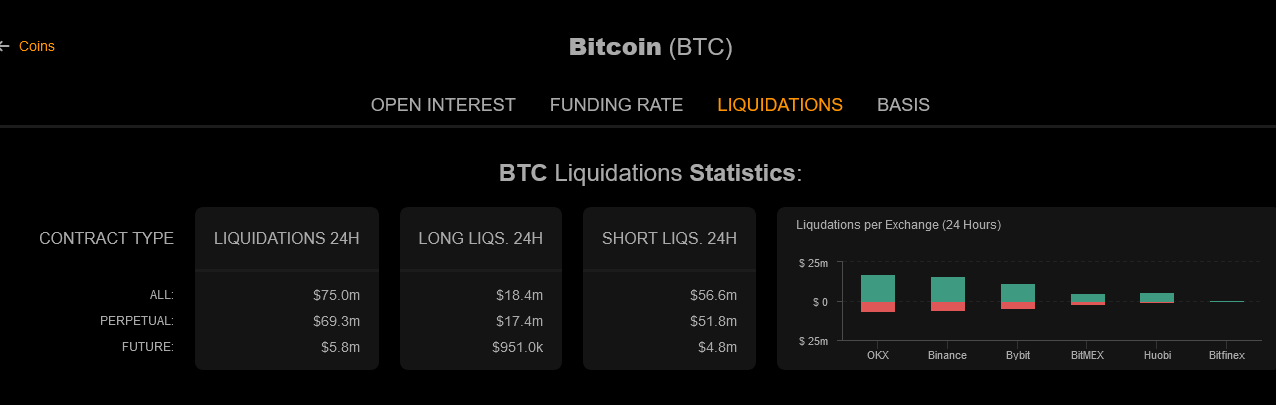

Currently, Bitcoin is trading at around $28,200, down nearly $2,000 from its peak on October 16. This highlights the high level of volatility in the BTC markets. According to data from Coinalyze, approximately $56.6 million of short positions were liquidated, along with $18.4 million of long positions. The majority of shorts, around $51 million, came from perpetual futures offered by OKX, Binance, and Bybit.

OKX saw the largest number of liquidations, with a significant percentage of traders shorting the price action. Specifically, $17.6 million in shorts were forcefully closed, along with $6.24 million in longs. Similar positions on Binance and Bybit were also unwound.

Leverage and Collateral

The liquidated amount mentioned includes traders who utilize leverage to capitalize on price movements. With perpetual contracts, traders can go long or short with leverage of up to 100X on certain exchanges. Leverage enables traders to amplify their positions by borrowing funds from the exchange. If prices move against the trader, the exchange will close the position and take the collateral provided before opening the trade.

Spot Bitcoin ETF Speculation

Contrary to rumors, the SEC has not approved the Bitcoin ETF application submitted by BlackRock, a major asset manager. The SEC has yet to approve any spot Bitcoin ETFs from firms like Fidelity. However, if the SEC were to approve a spot Bitcoin ETF, it could simplify institutional access to Bitcoin in a regulated manner. The crypto community remains optimistic about BTC’s future, especially with the upcoming halving of network rewards in 2024. Some analysts predict that BTC prices could surpass immediate resistance at $32,000 following a spot BTC ETF approval.

Hot Take: Uncertainty and Volatility Shake Crypto Markets

The recent false reports regarding a potential spot Bitcoin ETF approval by the SEC have caused significant volatility and uncertainty in the crypto markets. Traders who had taken leveraged positions faced forced liquidations, resulting in losses of over $74 million. While these events highlight the risks associated with trading cryptocurrencies, they also underscore the importance of accurate information and cautious decision-making in this space. Moving forward, market participants will closely monitor regulatory developments and remain hopeful for positive news regarding spot Bitcoin ETFs.

Bitro Conwell stands as an intellectual architect, weaving together the roles of crypto analyst, meticulous researcher, and editorial virtuoso with finesse. Amidst the digital intricacies of cryptocurrencies, Bitro’s insights resonate harmoniously with seekers of all stripes, showcasing a profound understanding. His ability to untangle the most complex threads within the crypto landscape seamlessly pairs his their editorial finesse, transforming intricacy into an artful tapestry of comprehension.