Police arrested a Jonesboro, Arkansas, supermarket employee for stealing cash to buy Bitcoin, presumably using one of many local cash-to-crypto services.

The suspect, Lacia Diane Holm, allegedly pilfered money from employer Bill’s Cost Supermarket to buy $1,020 worth of Bitcoin on June 21.

Grocery Store Thief Likely Used In-Store ATM

Police found black bag containing the stolen funds held two receipts for Bitcoin purchases worth $570 and $250. While reports redacted information, the grocery store manager is believed to have stolen several thousand dollars.

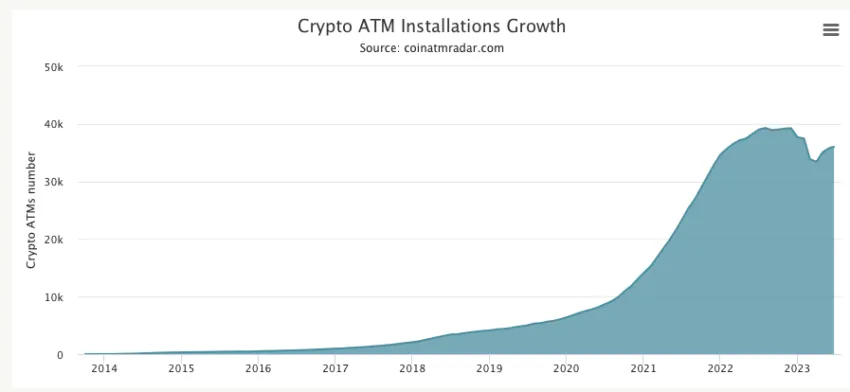

Crypto users predominantly use ATMs to buy Bitcoin with cash. According to Coin ATM Radar, at least 20 Bitcoin ATMs operate in Jonesboro.

It appears the grocery store manager likely used the ATM LibertyX operates inside Bill’s Cost Supermarket, which would explain why Bitcoin receipts were in the same bag as the stolen funds.

If found guilty of felony theft, Holm could face prison time and a fine. Meanwhile, her motive is unknown.

In total, operators added 1507 new ATMs in May, with Athena Bitcoin and Bitstop contributing 398 and 261.

Crypto-to-Cash Operators Pursue AML Compliance

But not all national regulators consider ATMs safe.

In February, the UK’s Financial Conduct Authority issued Bitcoin operators cease and desist orders for operating without proper approval. Before that, Singapore’s Monetary Authority banned crypto kiosks in public places to protect consumers.

However, contrary to popular belief, Bitcoin ATMs are not only used for crime.

Currently, operators Coinsource, Digital Mint, and CoinFlip hold registrations with the US Treasury Department’s Financial Services and Enforcement Network as Money Services Business.

Accordingly, they must comply with the bureau’s anti-money laundering and Know-Your-Customer requirements.

Learn more about anonymity vs. pseudonymity in crypto here.

Additionally, these firms belong to a consortium, the Cryptocurrency Compliance Cooperative. The organization advocates compliance with the highest standards for businesses in the cash-to-crypto service industry.