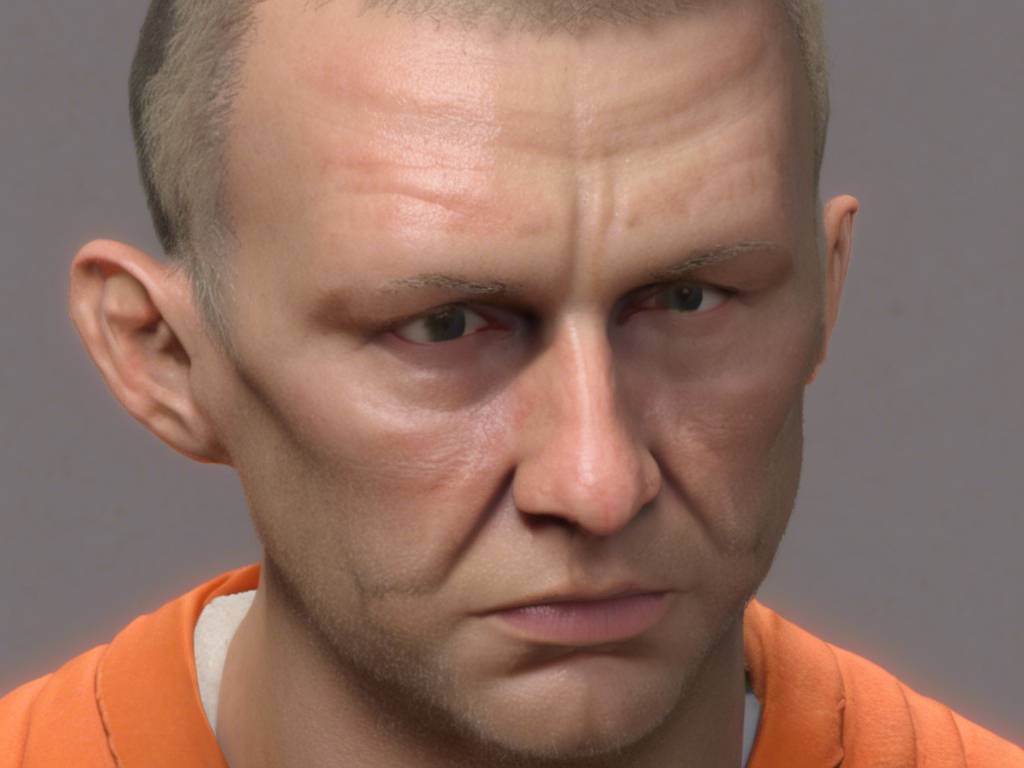

Understanding the Impact of Sam Bankman-Fried’s 25-Year Prison Sentence 🚨

Former FTX customers can now breathe a sigh of relief as Sam Bankman-Fried has received a 25-year prison sentence. Manhattan Federal Judge Lewis Kaplan’s decision marked the end of a significant chapter, with prosecutors labeling the FTX saga as one of the US’s largest financial frauds. Despite this, unanswered questions remain, leaving the crypto industry speculating about the adequacy of the imposed sentence.

The Fairness Behind SBF’s Lengthy Sentence

“This was a fraud of epoch scope,” commented Samson Enzer, a Partner at Wall Street Law Firm Cahill Gordon & Reindel LLP. Enzer’s viewpoint raises discussions about whether a 25-year prison term is sufficient for Bankman-Fried.

- Enzer explained that U.S. federal sentencing guidelines often recommend sentences exceeding 100 years for crimes similar to Bankman-Fried’s, underscoring the gravity of the situation.

- Bankman-Fried’s sentencing reflects a careful balance of various considerations, including deterrence and recognition of his age, as pointed out by Enzer.

Could SBF’s Appeal Alter His Sentence?

Upon receiving his conviction and prison sentence, Bankman-Fried opted to appeal, challenging both aspects of the legal process.

- Legal expert Enzer anticipates that Bankman-Fried could argue for improperly obtained convictions and unfair trials during the appeal process.

- The appeal process could potentially lead to a longer prison sentence, although Enzer deems such an outcome improbable.

Learning from Past Mistakes: Industry Implications

Despite the lingering questions surrounding Bankman-Fried’s case, there are valuable lessons for the blockchain industry to absorb from this experience.

- Enzer believes that the industry’s ability to identify and eliminate bad actors, whether in blockchain technology or traditional finance, showcases a positive evolution towards maturity and consumer protection.

- However, caution is advised by Rosenfeld, emphasizing the importance of due diligence and accountability among industry participants to uphold integrity and transparency.

Hot Take: Reflecting on the Future of Digital Assets 🌟

As the crypto community processes the implications of Sam Bankman-Fried’s sentence, the focus shifts towards embracing a new era of accountability and oversight within the industry. While challenges remain, the lessons learned from this case pave the way for a more responsible and resilient digital assets ecosystem.

Wyatt Newson emerges as a luminary seamlessly interweaving the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the dynamic canvas of digital currencies, Wyatt’s insights resonate like vibrant brushstrokes, capturing the attention of curious minds across diverse landscapes. His ability to untangle intricate threads of crypto intricacies harmonizes effortlessly with his editorial mastery, transmuting complexity into a compelling narrative of comprehension.